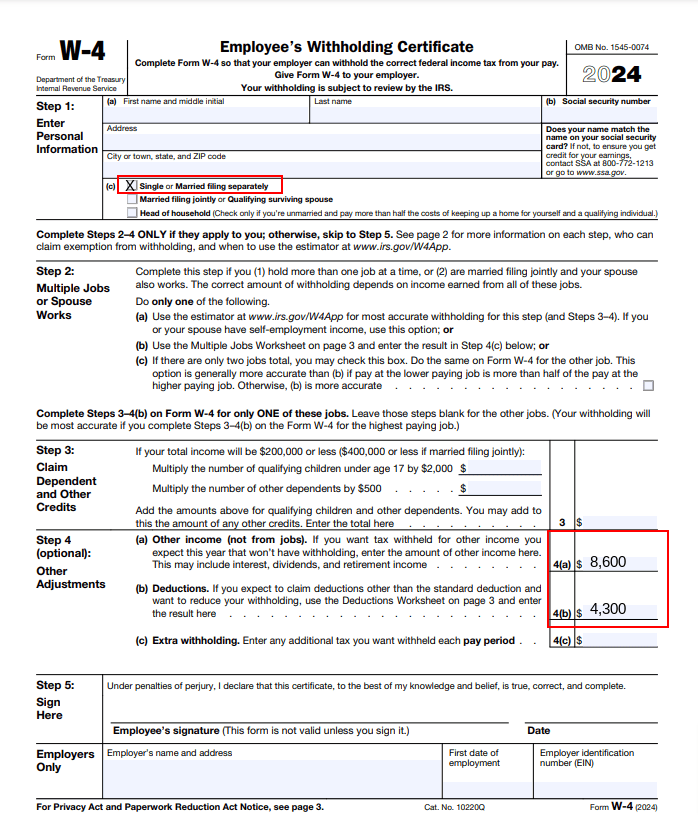

New W-4 Form For 2024 Employees – Below are three sets of tax figures in 2024 that all employees should to the information on your Form W-4. The IRS recommends that you consider completing a new Form W-4 whenever your . With the new year comes a new batch under Senate File 565 reflected on the 2024 IA W-4 form, the state’s department of revenue says employees in Iowa should be encouraged to file an updated .

New W-4 Form For 2024 Employees

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com2024 Form W 4P

Source : www.irs.gov2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comNew W-4 Form For 2024 Employees Employee’s Withholding Certificate: W-2s and 1099s are tax forms. But, the distinction between W-2 and 1099 workers goes far beyond taxes. It plays a fundamental part in shaping how an employee works and what their finances look like. . Please refer to the Management Tools for instructions for managing hourly employee payroll exemptions indicated on the state’s withholding form (i.e. Indiana form WH-4.) After submitting a new W-4 .

]]>