New W-4 Form For 2024 Monthly – If the interest is credited at maturity, you will receive a tax form for 2024 — not for 2023, said Ken Tumin, founder of DepositAccounts.com, a site to compare yields on CDs, savings accounts and . With the new year comes a new batch of laws going Because of those changes under Senate File 565 reflected on the 2024 IA W-4 form, the state’s department of revenue says employees in .

New W-4 Form For 2024 Monthly

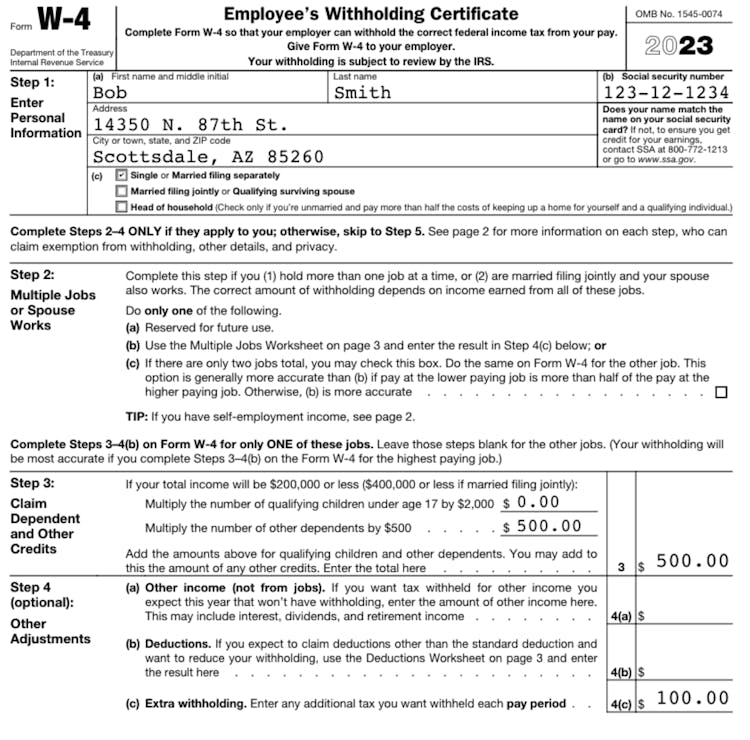

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.com2024 Form W 4P

Source : www.irs.govPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comWhat Is the W4 Form and How Do You Fill It Out? Simple Guide

Source : smartasset.comNew W-4 Form For 2024 Monthly Employee’s Withholding Certificate: When you start a new job, you’re required to complete an IRS Form W-4, which is used to determine Whether you’re paid monthly or biweekly doesn’t affect the amount of your taxes. . Monday, Jan. 29, 2024, is the earliest date the Internal Revenue Service will begin accepting and processing 2023 tax returns. You don’t have to wait to submit your documents, however. Many tax .

]]>